How To Increase Your American Express Credit Limit Online

Increasing your American Express credit limit online can open the door to greater purchasing power and financial flexibility. Whether you're looking to make a big purchase, improve your credit utilization ratio, or enjoy better rewards, having a higher credit limit can be beneficial. In this article, we will provide you with a comprehensive guide on how to increase your American Express credit limit online, ensuring that you have all the knowledge and tools needed to make this process seamless.

We'll delve into the reasons why you might want to request a credit limit increase, the eligibility criteria, and the step-by-step process to do so online. Additionally, we will share tips on how to improve your chances of approval, as well as what to expect after submitting your request. With the right approach, increasing your credit limit can be a straightforward and rewarding experience.

As we explore this topic, you will also find valuable insights, statistics, and expert recommendations to help you navigate the world of credit limits. Whether you are a new cardholder or have been with American Express for years, this guide is designed to empower you with the information you need.

Table of Contents

- Why Increase Your Credit Limit?

- Eligibility Criteria for Credit Limit Increase

- How to Request a Credit Limit Increase Online

- Tips for Improving Your Chances of Approval

- What to Expect After Requesting an Increase

- Impact on Your Credit Score

- Common Myths About Credit Limit Increases

- Conclusion

Why Increase Your Credit Limit?

Increasing your American Express credit limit can offer several advantages that contribute to your overall financial health. Here are some key reasons why you might consider requesting an increase:

- Greater Purchasing Power: A higher credit limit allows you to make larger purchases without maxing out your card.

- Improved Credit Utilization Ratio: Increasing your limit can lower your credit utilization ratio (the percentage of your total available credit that you are using), which is a significant factor in your credit score.

- More Rewards: A higher limit may enable you to leverage your card for more significant expenses, earning you more rewards points or cash back.

- Financial Flexibility: With a higher limit, you can manage unexpected expenses more comfortably without affecting your credit score.

Eligibility Criteria for Credit Limit Increase

Before you request an increase, it's essential to understand the eligibility criteria set by American Express. While specific requirements may vary, here are some common factors that could influence your eligibility:

- Account History: American Express typically prefers cardholders with a good payment history and responsible credit usage.

- Time with American Express: Longer relationships with the card issuer often improve your chances of approval.

- Current Credit Limit: Having an existing credit limit that is not already maxed out may also play a role.

- Credit Score: A healthy credit score can significantly boost your chances of receiving a credit limit increase.

How to Request a Credit Limit Increase Online

Requesting a credit limit increase from American Express is a straightforward process that you can complete online. Follow these steps to get started:

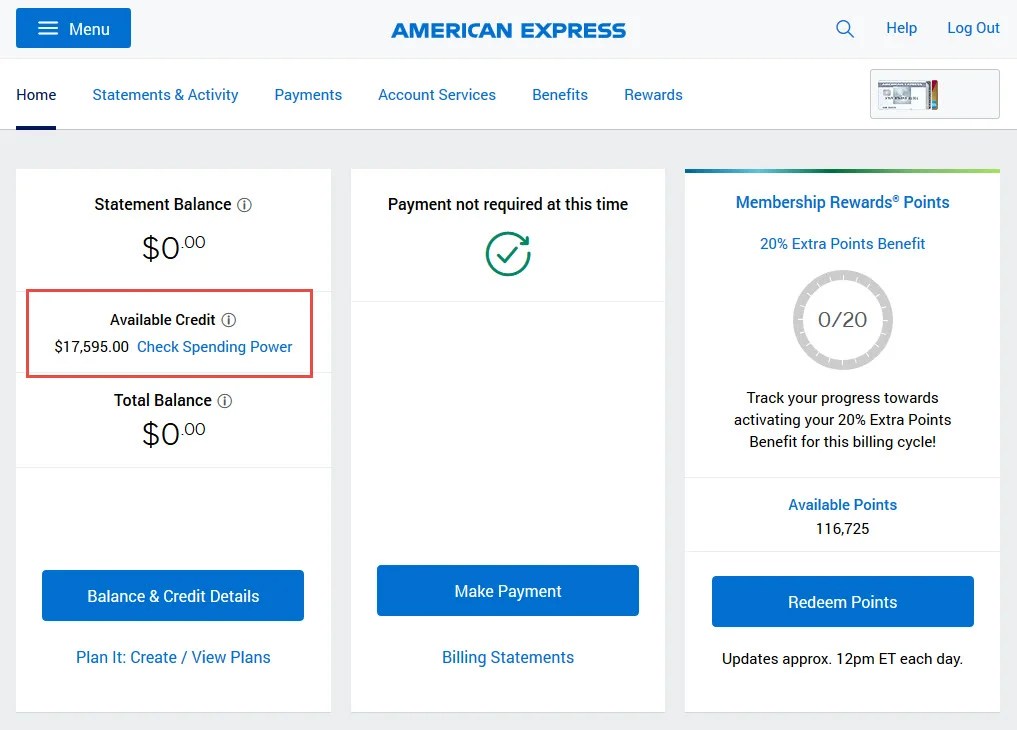

- Log in to Your Account: Go to the American Express website and log in to your account using your credentials.

- Navigate to Account Services: Once logged in, find the "Account Services" tab in the main menu.

- Select "Request Credit Limit Increase": In the Account Services menu, look for the option to request a credit limit increase.

- Fill Out the Form: Provide the required information, including your desired credit limit and your annual income.

- Submit Your Request: Review your information for accuracy and submit your request.

Tips for Improving Your Chances of Approval

To enhance your chances of getting your credit limit increase approved, consider these helpful tips:

- Maintain a Good Payment History: Always pay your bills on time to demonstrate responsible credit management.

- Keep Your Credit Utilization Low: Aim to use less than 30% of your available credit to maintain a healthy credit utilization ratio.

- Update Your Income Information: Ensure that your reported income is current and accurately reflects your financial situation.

- Be Mindful of Recent Credit Inquiries: Avoid applying for new credit cards or loans shortly before requesting an increase, as multiple credit inquiries can negatively impact your credit score.

What to Expect After Requesting an Increase

After submitting your request for a credit limit increase, you will typically receive a decision within a few minutes. However, in some cases, American Express may take longer to review your application. Here’s what to expect:

- Immediate Approval: You may receive an instant decision, allowing you to enjoy your new credit limit right away.

- Further Review: If your request requires additional review, you may be notified via email or through your online account.

- Notification of Decision: Regardless of the outcome, you will receive a notification regarding the status of your request.

Impact on Your Credit Score

When you request a credit limit increase, it’s natural to wonder how it might affect your credit score. Here are some factors to consider:

- Hard Inquiry: Depending on your credit profile and the amount of the increase requested, American Express may conduct a hard inquiry, which could temporarily lower your score.

- Improved Credit Utilization: If approved, a higher credit limit can lower your credit utilization ratio, which can positively influence your credit score over time.

- Long-term Benefits: Responsible use of your increased credit limit can lead to a stronger credit profile in the long run.

Common Myths About Credit Limit Increases

There are several misconceptions about credit limit increases that can lead to confusion. Here are some common myths debunked:

- Myth 1: Requesting a credit limit increase will always hurt your credit score.

Fact: While a hard inquiry may occur, the overall impact can be positive if managed responsibly. - Myth 2: You should only request an increase if you need it.

Fact: Regularly reviewing and requesting increases can be part of a healthy credit strategy. - Myth 3: All credit limit increase requests are approved.

Fact: Approval depends on various factors, including your creditworthiness and account history.

Conclusion

Increasing your American Express credit limit online is an accessible process that can enhance your financial flexibility and improve your credit health. By understanding the reasons for requesting an increase, knowing the eligibility criteria, and following the right steps, you can maximize your chances of approval. Remember to maintain a good payment history, keep your credit utilization low, and submit accurate information.

If you found this article helpful, we encourage you to leave a comment, share it with others, or explore more of our financial resources. Your journey to better financial management starts with informed decisions!

Thank you for reading, and we look forward to seeing you back on our site for more valuable insights and tips!

You Also Like

Genshin Elements Shield Break: A Comprehensive Guide To Mastering Elemental ReactionsHow To Grill 1 Inch Pork Chops: A Complete Guide

Understanding Platform Meaning In Computer: A Comprehensive Guide

Liverpool FC: This Is Anfield - A Journey Through History And Glory

Nutritional Drink Ensure: A Comprehensive Guide To Your Health

![Amex Credit Limit Increase Guide (How to Request) [2021] UponArriving](https://i2.wp.com/uponarriving.com/wp-content/uploads/2018/09/Amex-Credit-Limit-Increase.png)